What is the Endowment Model?

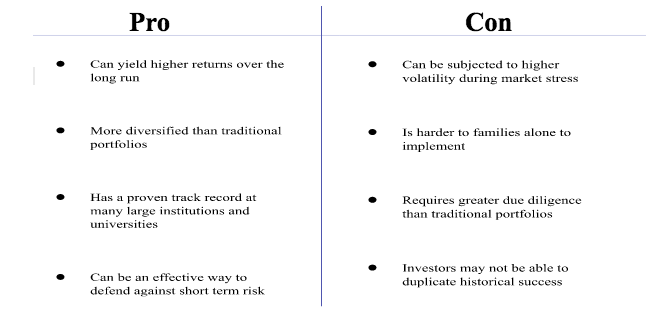

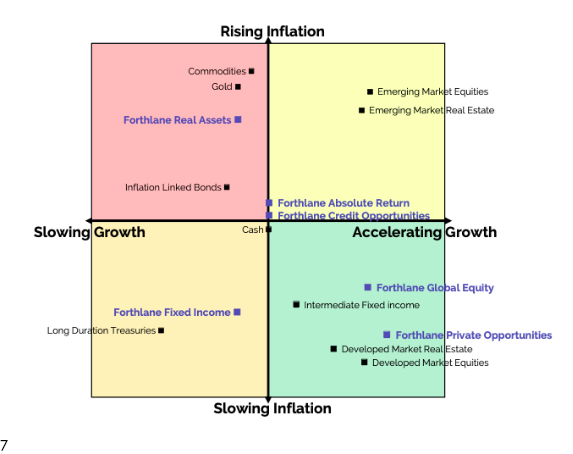

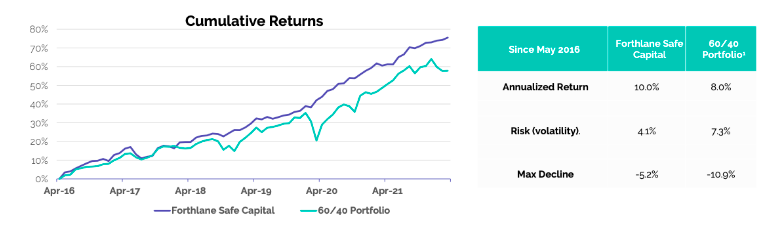

It stands to reason that pension funds and endowments must focus first on capital preservation. Reduced volatility, then, is key. This model is based on Modern Portfolio Theory, developed by Nobel Prize winner Harry Markowitz. The model demonstrates that risk-adjusted returns can be improved with diversification across asset classes with varied correlation. The result is attractive annual returns with the benefit of moderate risk.

The endowment model started to gain popularity in the 1990s when endowments began focusing on diversifying for the long term rather than the short term. Rather than the traditional allocation of mainly equities and bonds, endowments began increasing allocations to “nonstandard” assets such as Real Estate, Venture Capital, Hegde Funds, Infrastructure and others. By the end of 2008, the largest foundations had 50 percent of their holdings in nonstandard assets, an increase from three percent in the early 1990s (Leibowitz et al., 2013).

Families, like pension funds and endowments, should focus on capital preservation through the same diversification strategy.